Will You Work Beyond Traditional Retirement Age?

More than seven out of 10 current workers in a recent survey said they expect a paycheck to play a role in their income strategy beyond traditional retirement age. In fact, 33% expect to retire at age 70 or older, or not at all.1

If you expect to continue working during your 60s, 70s, or beyond, consider the advantages and disadvantages carefully. Although working can enhance your retirement years in many ways, you may also face unexpected consequences, particularly when it comes to Social Security.

Advantages

There are many reasons why you may want to work during retirement. First and perhaps most obvious, a job offers a predictable source of income that can help pay for basic necessities, such as food, housing, and utilities.

Working may also allow you to continue saving on a tax-deferred basis through a work-based retirement savings plan or IRA. Traditional retirement accounts generally require you to take minimum distributions (RMDs) after you reach age 73 or 75, depending on your year of birth; however, if you continue working past RMD age, you can typically delay RMDs from a current employer’s plan until after you retire, as long as you don’t own more than 5% of the company. (Roth IRAs and, beginning in 2024, work-based Roth accounts do not impose RMDs during the account owner’s lifetime.)

Moreover, employment can benefit your overall well-being through social engagement with colleagues, intellectual stimulation, and, if you’re employed in a field that requires exertion and movement, mobility and fitness.

Working may also provide access to valuable health insurance coverage, which can supplement Medicare after the age of 65. Keep in mind that balancing work-sponsored health insurance and Medicare can be complicated, so be sure to seek guidance from a qualified professional.

A paycheck might also allow you to delay receiving Social Security benefits up to age 70. This will not only increase your monthly benefit amount beyond what you’d receive at early or full retirement age, it will add years of earnings to your Social Security record, which could further enhance your future payments.

If one of your financial goals is to leave a legacy, working longer can help you continue to build your net worth and preserve assets for future generations and causes.

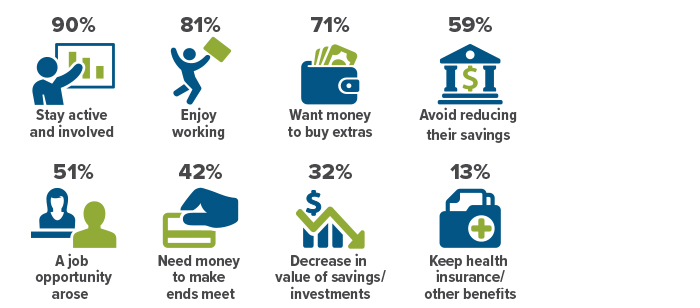

Why Retirees Work

When asked why they continue to work for pay, retirees often cited positive reasons.

Source: Employee Benefit Research Institute, 2023 (multiple responses allowed)

Disadvantages

There are some possible drawbacks to working during retirement, especially regarding Social Security. For instance, if you earn a paycheck and receive Social Security retirement benefits before reaching your full retirement age (66–67, depending on your year of birth), part of your Social Security benefit will be withheld if you earn more than the annual Social Security earnings limit. However, the reduction is not permanent; in fact, you’ll likely receive a higher monthly benefit later. That’s because the Social Security Administration recalculates your benefit when you reach full retirement age and omits the months in which your benefit was reduced.

After reaching full retirement age, your paycheck will no longer affect your benefit amount. But if your combined income (as defined by Social Security) exceeds certain limits, it could result in federal taxation of up to 85% of your Social Security benefits.

Perhaps the biggest disadvantage to working during retirement is... working during retirement. In other words, you’re not completely free to do whatever you want, whenever you want, which is often what people most look forward to at this stage of life.

Finally, a word of caution: Despite your best planning and efforts, you may find that you’re unable to work even if you want to. Consider that nearly half of today’s retirees left the workforce earlier than planned, with two-thirds saying they did so because of a health problem or other hardship (35%) or changes at their company (31%).2

For these reasons, it may be best to focus on accumulating assets as you plan for retirement, viewing work as a possible option rather than a viable source of income.