Keeping You On Course To Help Meet Your Goals

Leveraging some of the most sophisticated planning tools available today, We utilize the Envision® plan as part of our Wealth Management process which helps to provide clarity and confidence about your financial future.

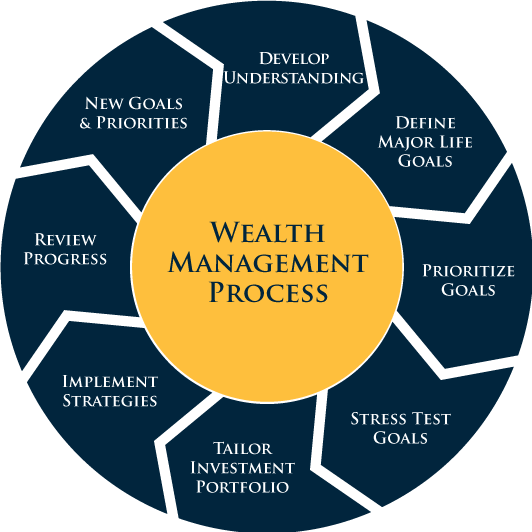

- Develop Understanding

- Define Major Life Goals

- Prioritize Goals

- Stress Test Goals

- Tailor Investment Portfolio

- Implement Strategies

- Review Progress

- New Goals and Priorities

Develop Understanding

At our initial conversation, we learn about you and your family and what is most important to you.

Define Major Life Goals

We then discuss your primary goals and dreams for the future.

Prioritize Goals

We explore your goals and help you prioritize them.

Stress Test Goals

To help determine the strength of your plan, we stress your financial goals by simulating random market conditions over your lifetime.

Tailor Investment Portfolios

We create an investment management strategy that will complement your long-term financial goals.

Implement Strategies

We will implement your investment strategy by creating an investment portfolio to help you reach your financial goals.

Review Progress

We review your Wealth Plan's progress and keep you informed of milestones and accomplishments.

New Goals & Priorities

We know change is an important part of your investment planning process. When your goals or financial circumstances change, or the markets fluctuate, it's easy to update your plan to account for the changes and measure the impact it has on your ability to reach your goals.

Important: The projections or other information generated by the Envision plan regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.

Envision® methodology: Based on accepted statistical methods, the Envision tool uses a simulation model to test your Ideal, Acceptable and Recommended Investment Plans. The simulation model uses assumptions about inflation, financial market returns and the relationships among these variables. The assumptions were derived from analysis of historical data. Using Monte Carlo simulation, the Envision tool simulates 1,000 different potential outcomes over a lifetime of investing varying historical risk return, and correlation amongst the assets. Some of these scenarios will assume strong financial market returns, similar to the best periods of history for investors. Others will be similar to the worst periods in investing history. Most scenarios will fall somewhere in between. Elements of the Envision presentations and simulation results are under license from Wealthcare Capital Management LLC. © 2003-2022 Wealthcare Capital Management LLC. All Rights Reserved. Wealthcare Capital Management LLC is a separate entity and is not directly affiliated with Wells Fargo Advisors.